Diamonds have been struggling to keep their luster after market difficulties and sales fluctuations, but production cuts in one of the largest diamond producers may see the market balancing out. Petra Diamonds Ltd has, along with many other diamond dealers, felt the tightening of their collective belts for some time now. However, could this strategy prove to be the solution to their financial woes? Can reducing the number of diamonds produced balance the market in the favor of dealers?

A diamond in the rough

Quoted recently, Petra’s CEO Johan Dippenaar stated, “We’re not as negative as most people are. It’s very much a stable market.” Highlighting that the major players of the diamond industry have displayed supply discipline in the past, and will continue to do so in the future, this decrease in diamond production will reduce costs for all involved. While De Beers, the world’s largest producer, has had to cut back output since 2015, this does not spell doom for the entire business. Cutters, polishers, and traders the world over have met difficulty amid constricting credit and jewelry sales, but Petra stands strong against the tide.

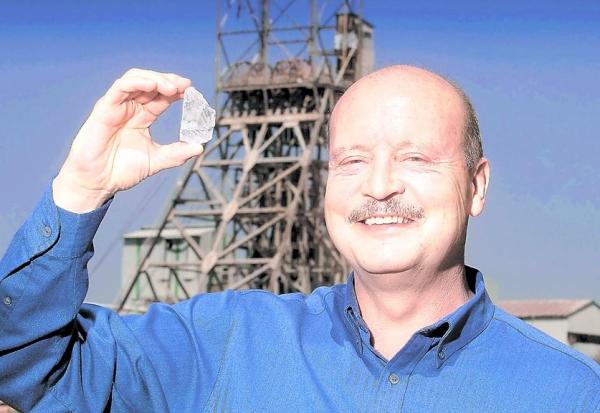

Petra’s CEO, Johan Dippenaar, holding a rare diamond

After suffering a minor dip in sales during the last six months, Petra’s prices have stabilized. “We have these leads and lags from the bigger producers that make the price,” Dippenaar said. Attributing their recent difficulty to the uncertain state of the diamond market. This state of flux resulted in a 9% drop in sales for 2014, but Petra, along with other major diamond distributors are hopeful for the future.

Beautiful and bold, diamonds always make an impact, captivating many with their multi-faceted gleam. Analysts chalk up the wavering sales to the rough state of our economy, and diamond dealers tend to agree. However, with the economy preparing to swing upward, the diamond district will surely benefit from the shift in circumstance.